Arthur Hayes Predicts Crypto Pullback in Q3 2025 Amid "Jobs Shock" and Tariff Concerns

However, the crypto market's performance so far in Q3 2025 suggests some underlying strength!

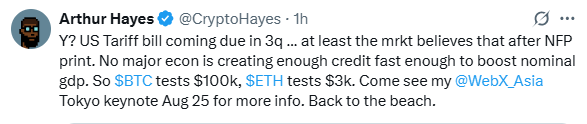

In the volatile world of cryptocurrency, predictions from influential figures like Arthur Hayes, co-founder of BitMEX, often send ripples through the market. Hayes recently shared a bearish outlook, forecasting a short-term pullback in crypto prices during Q3 2025. This comes on the heels of the recent "Jobs Shock" Non-Farm Payrolls (NFP) data, which has heightened economic uncertainties. Hayes argues that impending US tariffs will weigh heavily on the economy, and without significant fiscal policies to generate credit and bolster nominal GDP growth, major cryptocurrencies like Bitcoin and Ethereum could test lower support levels.

Hayes specifically anticipates Bitcoin dropping to test the $100,000 mark and Ethereum retreating to $3,000. This prediction is rooted in his analysis of current macroeconomic indicators, suggesting a potential correction amid broader market pressures. But what exactly triggered this outlook, and how has the crypto market performed so far in Q3 2025?

Let's dive deeper.

Understanding the "Jobs Shock" NFP Data

The "Jobs Shock" refers to the July 2025 US Non-Farm Payrolls report, released on August 1, 2025, which revealed significantly weaker-than-expected employment figures. The US economy added just 73,000 jobs in July, falling short of economists' expectations of around 104,000 new positions. This marked a sharp slowdown in hiring, with the unemployment rate rising to 4.2% from previous levels. Adding to the alarm, revisions to prior months' data were drastically lower: May and June job totals were revised downward by a combined 258,000 positions, painting a gloomier picture of the labor market.

This weak report stirred recession fears across financial markets, leading to a sell-off in stocks and cryptocurrencies. Average wages rose 3.9% year-over-year, outpacing inflation, but the overall data signaled potential cracks in the US economy.

Analysts noted that this could prompt the Federal Reserve to consider more aggressive interest rate cuts, but in the short term, it has amplified concerns about economic stability—aligning with Hayes' view on the impact of upcoming tariffs.

Crypto Market Performance in Q3 2025: Bitcoin, Ethereum, and Overall Trends

As we enter August 2025, Q3 (July-September) is still unfolding, but early performance data provides context for Hayes' bearish call. The overall cryptocurrency market has shown mixed results, with total market capitalization experiencing a slight decline.

Overall Crypto Market: The total crypto market cap is currently around $3.76 trillion, reflecting a -6.06% change in the last 24 hours and a 64.23% increase year-over-year. Analysts predict it could surge to $4.3–$4.5 trillion in Q3 if bullish trends continue, though recent volatility and the NFP shock introduce downside risks. Bitcoin's dominance has climbed to about 64%, its highest since early 2021, indicating a shift toward BTC amid uncertainty.

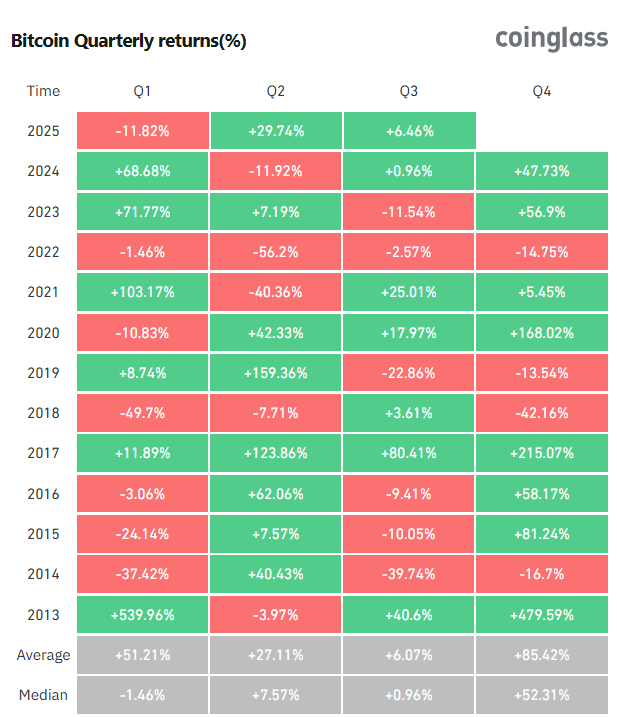

Bitcoin (BTC): Bitcoin started Q3 2025 with a modest 1.61% gain, trading in a tight range between approximately $107,386 and $109,117 after a 0.8% daily drop. It dipped to $105,000 on the Q3 open but maintained above that level, with an all-time high of $122,000 reached in July, fueled by ETF demand. Current forecasts suggest potential growth to $117,584 by early August, but Q3 has been characterized by volatility.

Source: Coinglass

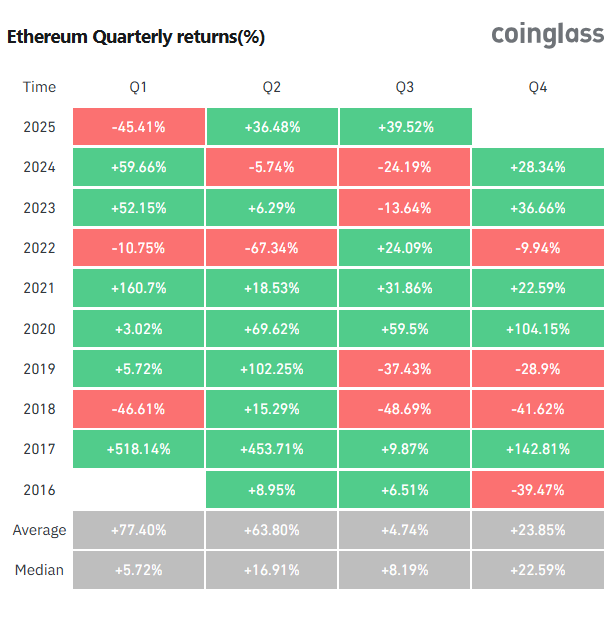

Ethereum (ETH): Ethereum has outperformed in Q3 2025 so far, surging 55.19% with prices nearing $3,800–$3,900 by late July, marking a strong rebound from previous drawdowns. Quarterly returns stand at +41.8% to +50.76%, driven by bullish MACD signals and a 250% increase in network activity. BlackRock's Ethereum ETF crossing $10 billion has further boosted sentiment, with predictions eyeing $17,000 by 2026.

Source: Coinglass

These stats highlight a market in flux: while Bitcoin and Ethereum have shown resilience and occasional surges, the broader crypto ecosystem is grappling with macroeconomic headwinds, including the NFP shock and potential tariffs. Volatility has spiked, and Q3 2025 could indeed see corrections if fiscal support remains absent.

Weighing Hayes' Bearish Outlook

Hayes' prediction ties into a narrative of economic slowdown, where tariffs could exacerbate inflation and reduce growth without counterbalancing policies. His call for Bitcoin to test $100K (a significant drop from recent highs around $114K-$115K) and Ethereum to $3K (from $3.5K-$3.6K) reflects a cautious stance, potentially offering buying opportunities for long-term holders.

However, the crypto market's performance so far in Q3 2025 suggests some underlying strength, particularly in Ethereum's rebound and Bitcoin's dominance. Factors like ETF inflows and network activity could mitigate the pullback.

Do you agree with his bearish outlook? Comment your thoughts.